Key learnings

- Understand the existing direct barriers faced by survivors.

- Learn about the systemic barriers faced by financial institutions and survivor support organisations.

The emotional impact of existing barriers

Despite considerable progress by several U.K. and U.S. banks, including those partnering with the FAST Survivor Inclusion Initiative and those enabling customers to open an account without traditional documentation, there are still numerous barriers to survivor financial inclusion.

Existing barriers to financial inclusion can be emotionally devastating for survivors who have already endured unimaginable trauma. Below are two survivor stories from Brooke*, a survivor consultant, and Timea E Nagy, a Survivor and Educator. Both stories highlight the importance of financial inclusion for survivors.

Brooke’s story

Brooke* is a survivor of modern slavery, who is currently being supported by the Salvation Army. Click the button below to read about the importance of survivor financial inclusion and the challenges that Brooke has faced when working with the bank.

Timea’s story

Timea E Nagy, Survivor and Educator, shared with us her experience of trafficking and the impact that exclusion from financial services had on her recovery.

“I was trafficked from Hungary to Canada when I was 21 years old for the purpose of sexual exploitation. I didn’t speak the language, I didn’t know anyone. When I was finally free, I did not receive any help and I had to navigate everything alone. I applied for a bank account but because I didn’t have status and I didn’t have proof of address and I only had one Hungarian ID, I wasn’t given a bank account.

I worked on three jobs, where English was not necessary, and all three jobs paid with cheques. I worked beyond minimum wage, so even though I was “free”, I still worked three jobs and slept for about 3 hours a day for about 2 years. I also lost about 30% of my wages due to cashing my cheques every time at Western Union. That 30% I lost on my cheques was crucial for me to try to get ahead.

I was always short on my rent, I never had enough money for food and during the harsh Canadian winters, I could only buy one pair of used winter boots that had a hole in the bottom of them. I had to wrap my feet in a plastic bag every morning before I would head out and walk to work. I did that so that the slush didn’t soak my socks and, ultimately, ensure I didn’t get frostbite.

Having access to proper banking would have truly made a huge difference when I was the most vulnerable.”

Timea E Nagy, Survivor, Educator, TC Online Institute

Understanding the direct survivor barriers

Survivors are often excluded from essential banking services, such as opening a bank account, due to insufficient documentation and other barriers. This negatively impacts survivors, limiting rehabilitation and reintegration into society. Our research has identified multiple direct barriers to financial inclusion which continue to affect U.K. and U.S. survivors of modern slavery. This section gives an overview of the barriers identified by survivors and survivor support organisations and provides context for the following chapter, Drive Financial Empowerment.

“Having access to proper banking would have truly made a huge difference when I was the most vulnerable.”

Timea E Nagy, Survivor, Educator, TC Online Institute

Misinformation among survivors

There is a cycle of misinformation among survivors about their eligibility to open an account, which prevents other survivors from exploring it as an option. Issues around misinformation have been linked to a lack of clear communication from retail banks to survivor support organisations. Many survivor banking options are not widely advertised for fear of misuse.

“The first thing we’re told is you can’t open an account, so the [other survivors] wouldn’t even bother to go and ask for it…the information they are getting is so limited, and the people who should be giving out the information are not giving it out…”

Paul, Survivor Consultant

Lack of Documentation

A significant proportion of U.K. and U.S. retail banks still lack clear frameworks to support opening survivor accounts where there is an absence of identity documents or proof of address.

The type of identity documentation survivors can provide is often influenced by a survivor’s immigration status. A survivor who has U.K. refugee status can use their Biometric Residence Permit to meet many bank’s identity requirements. However, not all survivors will be eligible for refugee status; they will be U.K. citizens facing alternative documentation challenges. Greater flexibility in acceptable documentation for survivors is fundamental, regardless of their immigration status.

“I could not open a bank [account] when I was an asylum seeker but when I got [refugee status] it was the easiest thing to open because they didn’t need much more [documentation]…just utility bills or something.”

Gabriela, Survivor Consultant

Previous account misuse due to trafficker control

Survivors who have experienced previous account misuse due to trafficker control can face barriers when they try to open another account due to low credit scores, fraud or immigration offences committed in the survivors’ name by traffickers. Specific survivor account protections and a trauma-informed approach can help to reduce the barriers caused by previous account misuse.

“I couldn’t open an account because I had banked with them at first and they had closed my account…they were sorting out the credit card which was there for a long time…they had written to me…but [due to] my perpetrator I didn’t see the letter…So, they closed my account without me knowing.”

Brooke, Survivor Consultant

Negative experiences with financial institutions

Negative experiences with branch staff can have damaging and long-lasting effects on survivors. Many survivors are forced to go from bank to bank, unable to find the support they need. This has resulted in a lack of trust and a negative attitude towards banks, even once a survivor succeeds in opening an account.

“I don’t go into the bank…because they won’t even listen to me…I’m not the kind of customer they want.”

Emma, Survivor Consultant

Language barriers and the unavailability of interpreters

Language barriers can prevent survivors from opening and managing an account, both in person and online. Survivors may feel uncomfortable entering a branch and may not feel understood by frontline staff. Language barriers also limit digital inclusion, with a lack of translatable services limiting independence and accessibility.

“There needs to be more awareness about supporting people with other languages. It’s all very much bring your friend in or bring someone but these people don’t have friends or family they can bring to translate.”

Caseworker, Survivor Support Organisation

Due to the lack of in-person interpreters, many banks require survivors to provide their own interpreter to help translate their services. However, this leaves survivors vulnerable to exploitation if they do not have a trusted interpreter.

Physical accessibility

Many survivors face physical barriers which prevent them from being able to access banking services. Key physical barriers survivors face include:

- Disability.

- Mental illness.

- The cost of transport.

- Difficulty navigating public transport (i.e. due to language barriers).

- Fear of travelling to an unknown place.

Banks, therefore, need to accommodate the specific vulnerabilities faced by survivors who are unable to enter a banking branch by ensuring that online services are accessible.

“I had no choice…they don’t have many branches and…the distance is always very very far from each other”

Emma, Survivor Consultant

Data poverty and digital literacy skills

Internet banking is essential for financial independence. However, data poverty and limited digital literacy skills can prohibit survivors from accessing key information and digital resources.

- Lack of access to data (due to data caps and high costs).

- Inability to access information and resources.

- Language barriers.

“[Internet banking is good]…apart from maybe struggling with the internet, you know…because sometimes the money is not enough to get credit or to pay for my internet…”

Paul, Survivor Consultant

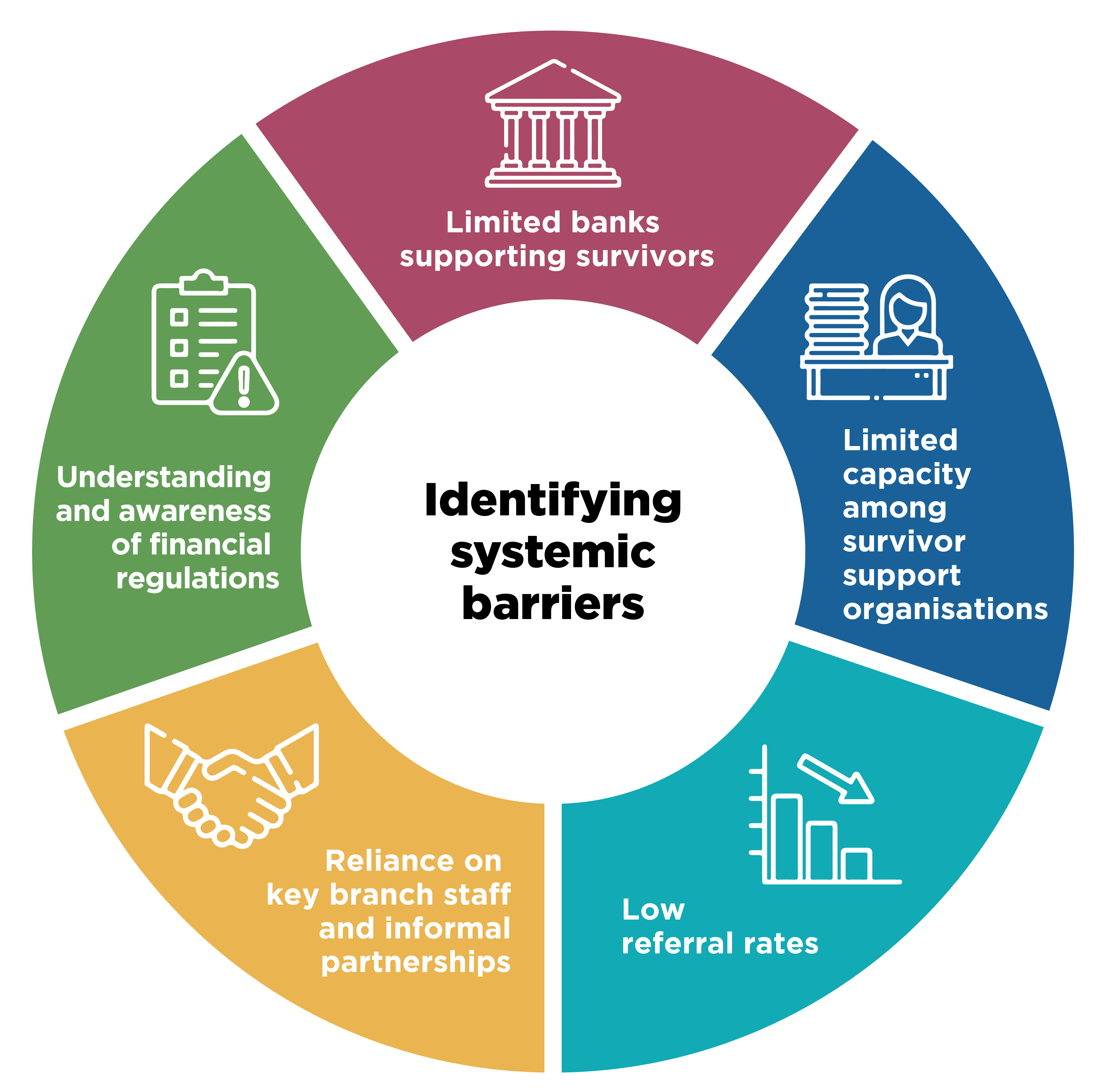

Identifying the systemic barriers

Organisational, systemic barriers affecting financial institutions and survivor support organisations limit survivor accessibility and support. These include a lack of awareness around services offered to survivors, the limited capacity of survivor support workers and the reliance on frontline branch staff. Redistributing survivor support and advertising the services banks are offering to survivors can help to break down these barriers.

Limited banks supporting access

The FAST Survivor Inclusion Initiative has been set up to facilitate survivor access to financial services. However, only three U.K. banks and eight U.S. banks are currently participants, while a handful of other banks have provided alternative pathways for survivors to open accounts. Unfortunately, these have not been widely advertised among survivor support organisations. Banks should ensure that survivors and survivor support organisations have access to information on the banking services available to survivors to help address survivor misinformation and increase survivor uptake.

“It’s been challenging to find a suitable bank where we know that we can refer clients without worrying about whether they have the requisite documents and how they will be treated when they visit a branch independently in the future.”

Caseworker, U.K. Survivor Support Organisation

Limited capacity among survivor support organisations

In order for most survivors to set up an account, they rely heavily on caseworkers within survivor support organisations. However, frontline caseworkers have limited capacity to navigate the banking system and provide wider financial literacy support. Strong partnerships between banks, survivor support organisations and other professionals such as survivor legal representatives or financial advisors can help to relieve this pressure and ensure that all parties involved understand the process of survivor account opening.

“We just don’t have the capacity to negotiate with banks and navigate the system…whilst doing this much casework, it’s difficult to find the time, creativity and enthusiasm needed for this.”

Caseworker, U.K. Survivor Support Organisation

Low referral rates

Some banks participating in the FAST Survivor Inclusion Initiative have reported low referral rates from survivor support organisations. This limits the ability to create an efficient system and disadvantages survivor accessibility. Support workers within survivor support organisations should be supported by banks to ensure that referring survivors is an easy and accessible procedure. Survivor support organisations also need access to all necessary information regarding which products and services banks are offering and how each financial institutions manages survivor onboarding and due diligence.

Reliance on key branch staff and informal partnerships

It is essential that frontline branch staff are trained to provide trauma-informed support to survivors who are entering the branch, given they will be the first point of contact for survivors. However, the reliance on frontline branch staff needs to be distributed to other support services, such as vulnerable customer specialist teams, who can support survivors with their longer-term financial well-being.

For survivor support organisations that have developed local partnerships with branch managers outside of the FAST Survivor Inclusion Initiative, there is a risk that referral pathways are terminated when staff move on. Survivor support should not, therefore, be limited to key individuals as this may limit the long-term programme of support banks can offer survivors.

In the US, there is a large quantity of small survivor support organisations which limits the ability to maintain long-lasting relationships and create clear referral pathways. Given their smaller capacity, there will be fewer survivors to refer to banks, resulting in longer periods of time between account openings. Information on the survivor referral process may be forgotten or individual support workers who originally navigated this may have moved on.

“We had a great relationship with one of the managers at our local branch but since they’ve moved on and the other members of staff didn’t have sufficient training, we haven’t been able to refer our clients…”

Caseworker, U.K. Survivor Support Organisation

Understanding and awareness of financial regulations

Strict policy and regulation make it challenging for financial institutions to accept alternative forms of identification. However, the regulations do allow for flexibility and it is possible, with the correct policies and risk management in place, to provide support for survivors without standard identity documentation. In order to promote financial inclusion, greater awareness needs to be raised among financial institutions to understand the boundaries between legal regulation versus bank de-risking policies.

Summary: Important guidance

- Ensuring that all customer-facing staff have undertaken trauma-informed training can help to provide a safe space for survivors.

- Identifying and training specific employees to become “Survivor Banking Champions” can ensure that survivors and survivor support organisations have a clear point of contact with the bank.

- Creating and sharing a clear information pack outlining the products available to survivors, necessary documentation and what to expect when opening an account can improve communication and accessibility.

- Consider flagging survivor accounts for the life of the account and provide specific account protections such as enhanced monitoring and fee waivers to protect survivors from re-exploitation and risk.

- Help to ensure greater accessibility by implementing measures to overcome language barriers, such as using external translation services or offering subtitled basic banking videos with multiple language options.

Find out more about “Survivor Banking Champions” within Employee training and protecting vulnerable customers.